Dispute Negative Items - Customize and send dispute letters to Bureaus to request getting those negative items off your report (for good).Evaluate Your Credit Report - Pull your credit report and identify all negative, harmful items that's keeping your 658 score suppressed.

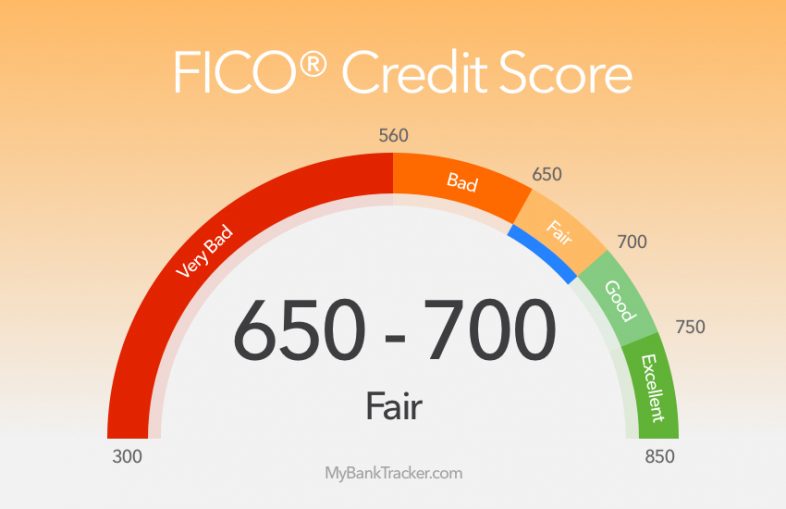

Repairing your credit is one of the best ways to fix your situation, and unlock the happy lifestyle you and your family deserve.Ī Credit Repair company like Credit Glory can: Lenders normally don't do business with borrowers that have fair credit because it's too risky. Mortgage, auto, and personal loans are somewhat difficult to get with a 658 Credit Score. But it occurs only in earlier versions of the VantageScore scale that are no longer used, and in the FICO Auto Score used for car loans.A 658 FICO® Score is considered “Fair”. In reality, a 900 score is either impossible or only relevant in special cases, experts say. Unlike the unicorns, a 900 score does exist. You may have heard rumors of credit scores as high as 900-or even higher.

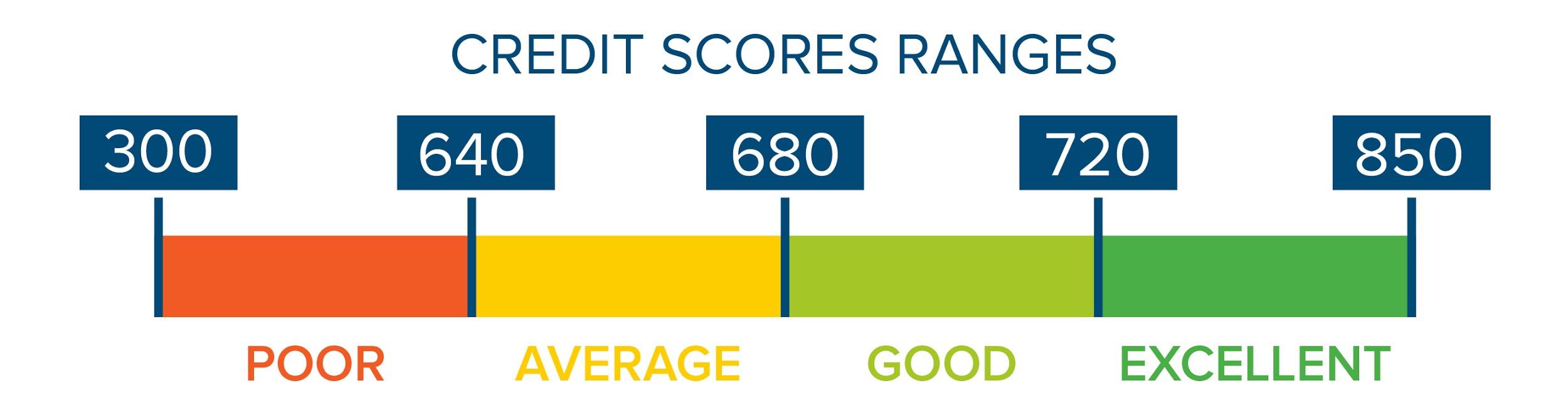

First, experts call any FICO score of 800 or above “perfect,” meaning that striving for an even higher score probably won’t get you better terms. Second, note that the VantageScore range is slightly different: any score of 781 or higher is seen as Excellent -likely due to Richardson’s explanation that scoring more Americans tends to bring the VantageScore averages down.ĩ00: the unicorn. There are a couple of other things to keep in mind about this range. For example, if your FICO score is 760 or better, you could qualify for a 60-month auto loan at an interest rate as low as 3%, experts say. Achieving an 800 FICO score may also open opportunities to reduce your monthly payments by refinancing older loans on better terms. Only 21% of Americans have excellent scores, and fewer than 1% of them are likely to become seriously delinquent in the future, according to Experian. That’s because lenders have a high degree of confidence people with scores in this range will repay their debts. People in the Excellent credit score range are the most likely to be approved for a credit card or loan, and they’re also likely to get the best available terms and/or interest rates. He said the difference is because, “We score 40 million more consumers and many of those consumers tend to have lower scores.”Īchieving a FICO score of 800 is the ultimate goal for many-and there’s good reason for that. Richardson said the average VantageScore 3.0 score as of early October 2019 was 686, slightly lower than the average FICO score. So, while credit bureaus like Experian name their own credit score ranges and labels based on VantageScore 3.0, these are the official VantageScore 3.0 ranges provided by Richardson: It provides only “credit tiers” in the context of the Consumer Financial Protection Bureau’s (CFPB’s) definition of an average credit score, which the CFPB calls “prime.” “We … leave it up to lenders and the bureaus to determine what is a ‘good’ credit score since that’s really in the eyes of a lender,” said Jeff Richardson, Vice President and Group Head–Marketing & Communications, in an email interview. 2 VantageScore Solutions takes a different approach. also lists the FICO credit score ranges and labels shown in the chart at its own web site, noting that the average American credit score falls into the “Good” range.

#Credit score ranges 658 how to#

Learn more in “ How to Check Your Credit Score for Free.”)įair Isaac Corp. Credit scores are based on factors such as payment history, overall debt levels, and the number of credit accounts. (If you don’t know your current score, it’s easy to find out. Credit score ranges help lenders determine the risk of lending to a borrower. And if you don’t like the implications of your credit score range, you can take actions that could change it. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates.

#Credit score ranges 658 code#

That’s because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember (such as “good” and “excellent”).Īlthough cracking the credit code won’t help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. But by the time you’ve considered the various credit score scales (including FICO, VantageScore and industry-specific scales like those used for auto loans), it can certainly feel that way.įortunately, you don’t need to be the hero of the Da Vinci Code to make sense of your credit score. Figuring out what a credit score of 640 (or 580 or 810, or …) means isn’t really as tough as cracking the Da Vinci Code.

0 kommentar(er)

0 kommentar(er)